41 a 10 year bond with a 9 annual coupon

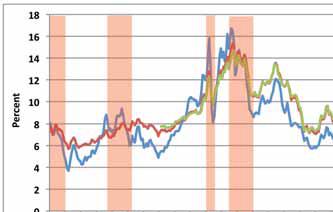

Market Yield on U.S. Treasury Securities at 30-Year ... Graph and download economic data for Market Yield on U.S. Treasury Securities at 30-Year Constant Maturity (DGS30) from 1977-02-15 to 2022-05-17 about 30-year, maturity, Treasury, interest rate, interest, rate, and USA. HOME DEPOT INC., THEDL-NOTES 2017(17/27) Bond | Markets ... The The Home Depot Inc.-Bond has a maturity date of 9/14/2027 and offers a coupon of 2.8000%. The payment of the coupon will take place 2.0 times per biannual on the 14.03..

iShares® iBonds® 2027 Term High Yield and Income ETF | IBHG Weighted Avg Coupon as of May 18, 2022 6.03% Weighted Avg Maturity as of May 18, 2022 4.89 yrs Effective Duration as of May 18, 2022 3.85 yrs Convexity as of May 18, 2022 -0.03 Option Adjusted Spread as of May 18, 2022 457.64 bps This information must be preceded or accompanied by a current prospectus.

A 10 year bond with a 9 annual coupon

Pnc Financial Services Groupdl-preferred Stk 2022(27/Und ... At the current price of 102.06 USD this equals a annual yield of 6.22%. The The PNC Financial Services Group Inc.-Bond was issued on the 4/26/2022 with a volume of 1000 M. USD. Follow us on: CVS HEALTH CORP. Bond | Markets Insider The payment of the coupon will take place 2.0 times per biannual on the 01.06.. At the current price of 100.88 USD this equals a annual yield of 2.47%. The CVS Health Corp.-Bond was issued on the ... COINBASE GLOBAL INC.DL-NOTES 2021(21/28) REG.S Bond ... The payment of the coupon will take place 2.0 times per biannual on the 01.04.. At the current price of 72.53 USD this equals a annual yield of 9.53%. The Coinbase Global Inc.-Bond was issued on ...

A 10 year bond with a 9 annual coupon. iShares® iBonds® Dec 2027 Term Corporate ETF | IBDS Use to seek income, build a bond ladder, and manage interest rate risk. The legal name of this fund is the iShares® iBonds® Dec 2027 Term Corporate ETF. The iShares iBonds Dec 2027 Term Corporate ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, investment-grade corporate bonds maturing in 2027. NBC921 Performance & Stats | NBI Secure Portfolio Investors 87.53M. -7.45%. Upgrade. Upgrade. Basic Info. Investment Strategy. The Portfolio's investment objective is to ensure a high level of current income and some medium-term capital appreciation. To do this, it invests primarily in a diverse mix of mutual funds (that may include exchange-traded funds ("ETFs")) that are fixed-income funds and ... How Attractive are the Astrea 7 PE Bonds? (Indicative ... When the bond matures after 10 years, you will get the last semi-annual coupon payment and your principal back (if the bond does not default). All three classes have mandatory call at the end of 5 years. This means that Astrea can forcefully redeem back the bonds, give you back the capital and any outsanding coupon payments. Best CD Rates Of May 2022 - Forbes Advisor For example, the national average interest rate for a 12-month CD as of April 18, 2022, is 0.17% APY, according to the FDIC, while the national average for a three-month CD is 0.06% APY. However ...

JNK: SPDR® Bloomberg High Yield Bond ETF To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 download a prospectus or summary prospectus now, or talk to your financial advisor. Read it carefully before investing. Fund Net Cash Amount as of May 18 2022 Net Cash Amount $97,477,907.57 Fund Net Asset Value as of May 18 2022 Netherlands 10 Years Bond - World Government Bonds The Netherlands 10 Years Government Bond reached a maximum yield of 1.413% (8 May 2022) and a minimum yield of -0.651% (9 March 2020). Go to Netherlands 10 Years Bond - Forecast Readings that may interest you Index Funds and ETFs: What They Are and How to Make Them Work for You 10-Year Mortgage Rates | Compare Rates Today | Bankrate Compare current 10-year mortgage rates Advertiser Disclosure Written by Zach Wichter On Monday, May 16, 2022, the national average 10-year fixed mortgage APR is 4.680%. The average 10-year... China becomes wild card in Sri Lanka's debt crisis Ethiopia persuaded Beijing in 2018 to forgive some interest and stretch out repayment of a 10-year loan for a $4 billion railway to 30 years. That reduced annual payments but added two more decades...

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 0.948% yield. 10 Years vs 2 Years bond spread is 60.7 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.00% (last modification in March 2016). The Germany credit rating is AAA, according to Standard & Poor's agency. United Kingdom 10 Years Bond - Historical Data United Kingdom 10 Years Government Bond Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column contains prices at the current market yield. Other columns refers to hypothetical yields variations (100 bp = 1%). United Kingdom Government Bonds Back to United Kingdom Government Bonds - Yields Curve Ranking The Best Passive Income ... - Financial Samurai As interest rates have been going down over the past 30 years, bond prices have continued to go up. With the 10-year yield (risk-free rate) at roughly 1.3%, we're in an interesting situation. The 10-year yield was at only 0.51% in August 2020. I believe long-term interest rates can stay low for a long time. 10-Year T-Note Futures Quotes - CME Group Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading, adjusting portfolio duration, curve trading, expressing directional ...

Vestjysk Bank A/S has signed a loan agreement for DKK 350 ... The loan carries a floating semi-annual coupon rate of CIBOR6 plus a credit spread of 200 bps. ... The drop in the markets comes along with gains in Treasury bonds - the 10-year Treasury note ...

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.904% yield. 10 Years vs 2 Years bond spread is 22.6 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

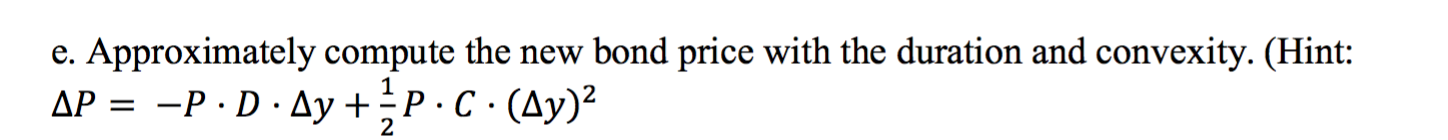

A 30-year maturity bond making annual coupon payments with ... A 30-year maturity bond making annual coupon payments with a coupon rate of 16.3% has duration of 10.54 years and convexity of 161.2. The bond currently sells at a yield to maturity of 9%. Required: What price would be predicted by the duration rule, if it's yield to maturity rises to 10%? (Do not round intermediate calculations.

High Yield Bond Fund | BHYIX | Institutional A high income solution. 2. Flexible in changing market conditions. 3. Seeks high income to maximize total return. Invests primarily in non-investment grade bonds with maturities of 10 years or less. The Fund normally invests at least 80% of its assets in high yield bonds, including convertible and preferred securities.

Interest Rates - YCharts 1-Year Eurozone Central Government Bond Par Yield Curve: May 11 2022-0.10% -- 10-Year Eurozone Central Government Bond Par Yield Curve: May 11 2022: 1.74% : 0.78% 15-Year Eurozone Central Government Bond Par Yield Curve: May 11 2022: 1.97% : 1.03% 2-Year Eurozone Central Government Bond Par Yield Curve

GENERAL MOTORS CO.DL-NOTES 2017(17/27) Bond | Markets Insider The General Motors Co.-Bond has a maturity date of 10/1/2027 and offers a coupon of 4.2000%. The payment of the coupon will take place 2.0 times per biannual on the 01.04..

Suppose a five-year, $1,000 bond with annual coupons has a ... Post by answerhappygod » Thu May 19, 2022 10:33 am Suppose a five-year, $1,000 bond with annual coupons has a price of $900.95 and a yield to maturity of 5.5%.

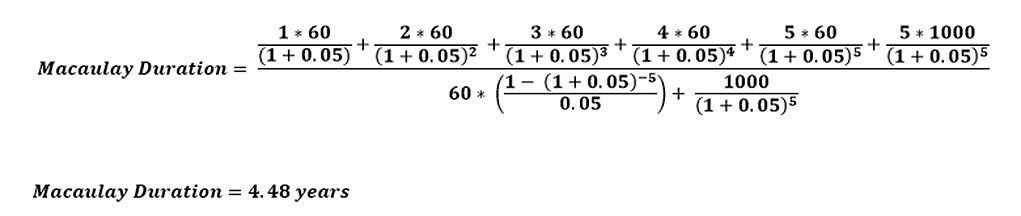

a. Find the duration of a 7% coupon bond making annual coupon payments if it has... - HomeworkLib

India 10 Years Bond - World Government Bonds India 10 Years Government Bond Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column contains prices at the current market yield. Other columns refers to hypothetical yields variations (100 bp = 1%). India Government Bonds Back to India Government Bonds - Yields Curve Related Topics

MBNE: SPDR® Nuveen Municipal Bond ESG ETF To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 download a prospectus or summary prospectus now, or talk to your financial advisor. Read it carefully before investing. Fund Net Cash Amount as of May 13 2022 Net Cash Amount $34,627.04 Fund Net Asset Value as of May 13 2022

Municipal Bonds | Tax-Advantaged Strategies | PIMCO The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns.

iShares® iBonds® 2023 Term High Yield and Income ETF | IBHC Get exposure to a diversified universe of high yield and BBB-rated corporate bonds maturing between January 1, 2023 and December 15, 2023 in a single fund. 2. Designed to mature like a bond, trade like a stock. Combine the defined maturity and regular income distribution characteristics of a bond with the transparency and tradability of a stock. 3.

COINBASE GLOBAL INC.DL-NOTES 2021(21/28) REG.S Bond ... The payment of the coupon will take place 2.0 times per biannual on the 01.04.. At the current price of 72.53 USD this equals a annual yield of 9.53%. The Coinbase Global Inc.-Bond was issued on ...

CVS HEALTH CORP. Bond | Markets Insider The payment of the coupon will take place 2.0 times per biannual on the 01.06.. At the current price of 100.88 USD this equals a annual yield of 2.47%. The CVS Health Corp.-Bond was issued on the ...

Pnc Financial Services Groupdl-preferred Stk 2022(27/Und ... At the current price of 102.06 USD this equals a annual yield of 6.22%. The The PNC Financial Services Group Inc.-Bond was issued on the 4/26/2022 with a volume of 1000 M. USD. Follow us on:

Post a Comment for "41 a 10 year bond with a 9 annual coupon"