42 what is zero coupon bonds

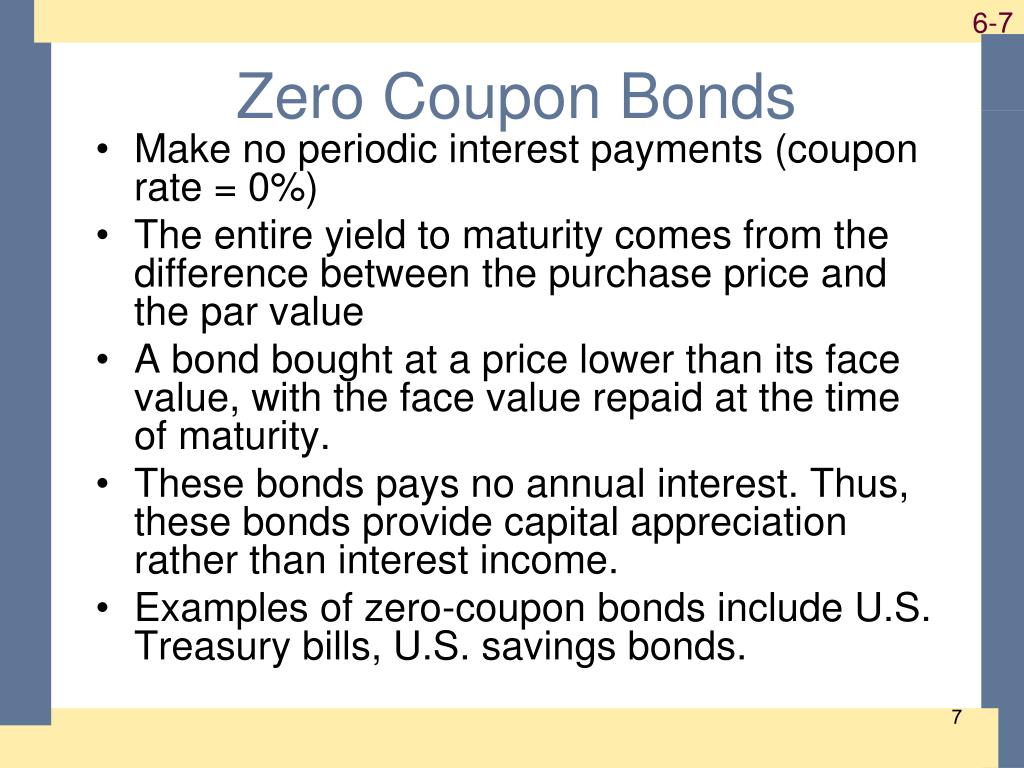

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Nov 25, 2020, 10:09 AM. Save Article Icon. A bookmark. Facebook Icon. The letter F ...

Zero Coupon Bond - Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

What is zero coupon bonds

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. What is a Zero-Coupon Bond? Definition and Meaning ... A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy.

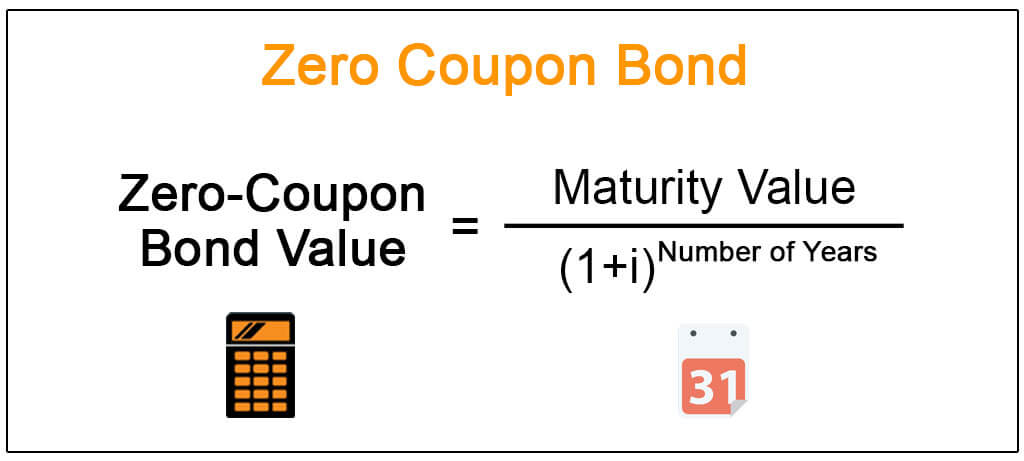

What is zero coupon bonds. 濫 What is a zero coupon curve? A zero curve is a special type of yield curve that maps interest rates on zero-coupon bonds to different maturities across time.Zero-coupon bonds have a single payment at maturity, so these curves enable you to price arbitrary cash flows, fixed-income instruments, and derivatives. What are Zero Coupon Bonds? Zero coupon bonds are sold at a substantial discount from the face amount. For example, a bond with a face amount of $20,000, maturing in 20 years with a 5.5% coupon, may be purchased for roughly $6,757. At the end of the 20 years, the investor will receive $20,000. The difference between $20,000 and $6,757 represents the interest that ... What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting A zero-coupon bond is one that is popular because of its ease. The face value of a zero-coupon bond is paid to the investor after a specified period of time but no other cash payment is made. There is no stated cash interest. Money is received when the bond is issued and money is paid at the end of the term but no other payments are ever made. What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder. What Is a Zero Coupon Swap? A zero coupon swap, based upon a zero coupon bond, changes the interest so that the floating rate is paid on interval, while the fixed rate is paid in one sum at contract's end. Alternative swap payments are possible, including the reverse and exchangeable zero coupon swaps. Currency backed coupons swaps have a different payment arrangement ...

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a type of debt security that provides profit for the investor when it reaches maturity. Unlike traditional bonds, zero-coupon securities don't provide interest payments during the life of the bond. Instead, investors make money on these bonds when they buy them at a deep discount. Zero Coupon Bonds Explained (With Examples) - Fervent ... The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. What is the price of this bond today, if the yield is 7%? Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... What is a Zero-Coupon Bond? Definition, Features ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years.

Zero coupon bond definition - AccountingTools Zero coupon bond definition January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds

Zero-Coupon Bonds: Pros and Cons Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

Zero Coupon Bond क्या है? - ICICIdirect In this article, find out what zero-coupon bonds are, their advantages and whether you should invest in them. Also, understand the pricing of a Zero Coupon Bond. Click here to read more.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure.

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

What Is a Zero Coupon Bond? - The Motley Fool In contrast, with a zero coupon bond with a face value of $100, paying 3%, you buy the bond for $74.41. You then wait 10 years, and at the end of those 10 years, the company pays you $100.

C. What is the value of a $1,000 zero-coupon bond | Chegg.com Transcribed image text: C. What is the value of a $1,000 zero-coupon bond that matures in 26 years when the required rate of return is 11%? D. What is the yield-to-maturity of a $1,000 bond with a coupon rate of 4%, a 20 year maturity, and a current price of $1,240?

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

What Is a Zero-Coupon Bond? Definition, Characteristics ... Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,...

What is a Zero-Coupon Bond? Definition and Meaning ... A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "42 what is zero coupon bonds"