45 coupon rate 10 year treasury

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ... 10-Year US Treasury Note - Guide, Examples, Importance of 10 ... Feb 04, 2022 · Treasury notes are issued for a term not exceeding 10 years. The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market.

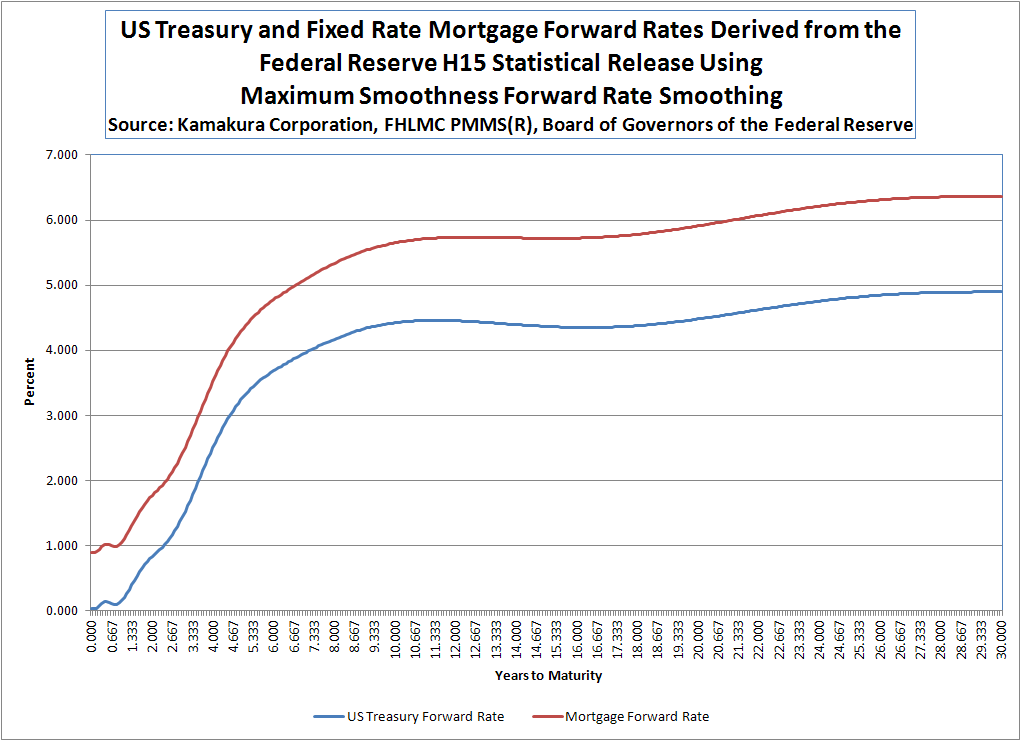

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-06-10 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in ...

Coupon rate 10 year treasury

10-Year T-Note Options Quotes - CME Group 10-Year T-Note Options - Quotes Venue: Auto-refresh is off There is currently no quotes data for this product. If you have any questions, please feel free to contact us. 10-Year Note Yield Curve Analytics Additional analytics for Treasury futures are available in our Treasury Analytics tool. View Yield calculation methodology here. CME FedWatch Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; , June 18, 2022. RELEASE TABLES H.15 Selected Interest Rates US.10: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 10 Year Treasury (US.10:Tradeweb) real-time stock quotes, news, price and financial information from CNBC.

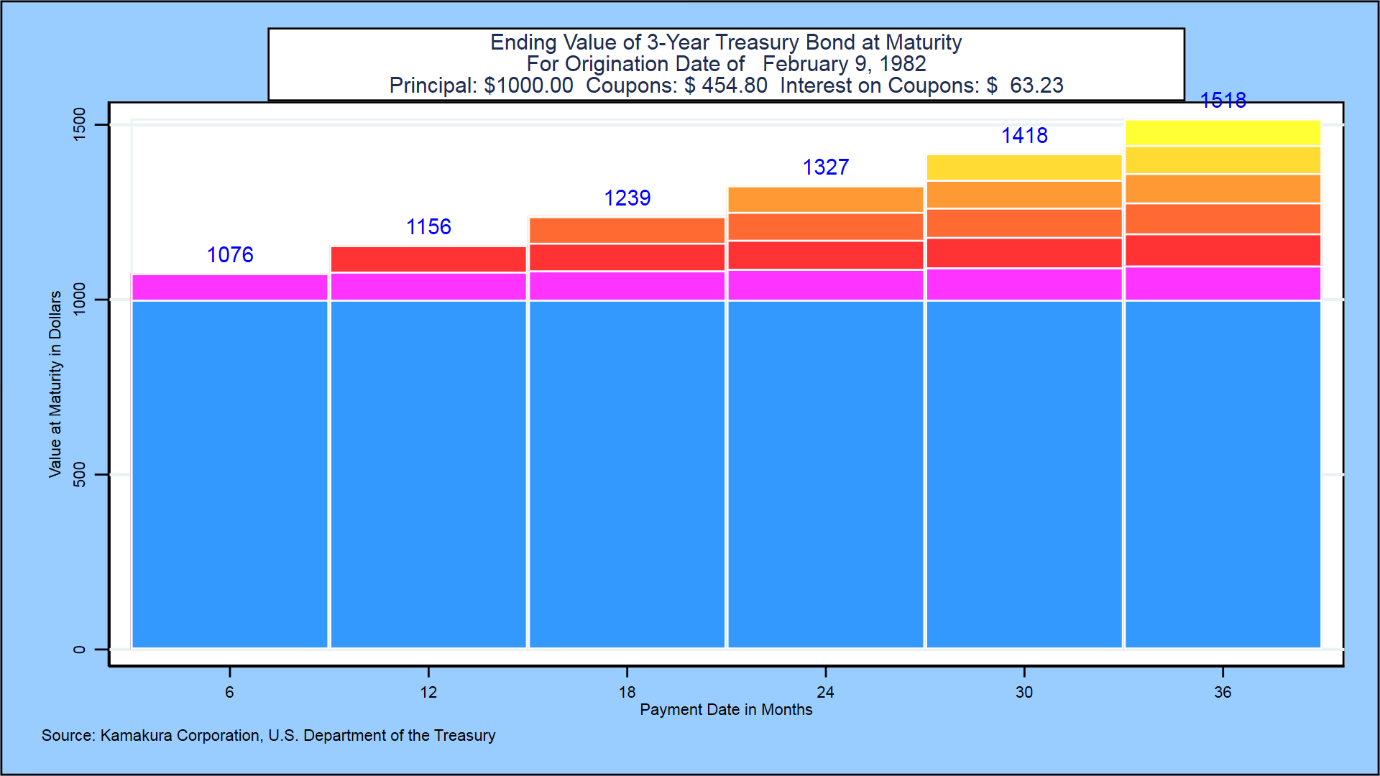

Coupon rate 10 year treasury. Treasury Return Calculator, With Coupon Reinvestment Treasury Return Calculator, With Coupon Reinvestment Investing June 12th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) 10 Year Treasury Yield: What It Is and Why It Matters Treasury Bills are loans to the federal government that mature at terms ranging from a few days to 52 weeks. 1 A Treasury Note matures in two to 10 years, while a Treasury Bond matures in 20 or 30... Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present

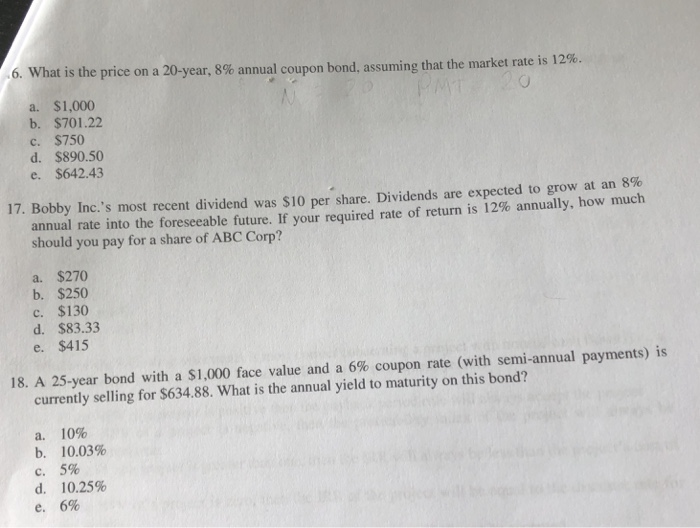

Understanding The 10-Year Treasury Yield - Forbes Advisor The 10-year Treasury yield also impacts the rate at which companies can borrow money. When the 10-year yield is high, companies will face more expensive borrowing costs that may reduce their ... US 10 Year Treasury Yield - Investing.com Get our 10 year Treasury Bond Note overview with live and historical data. ... A single buyer purchased all one billion Australian bonds at auction with a 1.25 coupon rate and 4.115 yield, ten ... 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of June 16, 2022 is 3.28%. Show Recessions Download Historical Data Export Image How Is the Interest Rate on a Treasury Bond Determined? If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

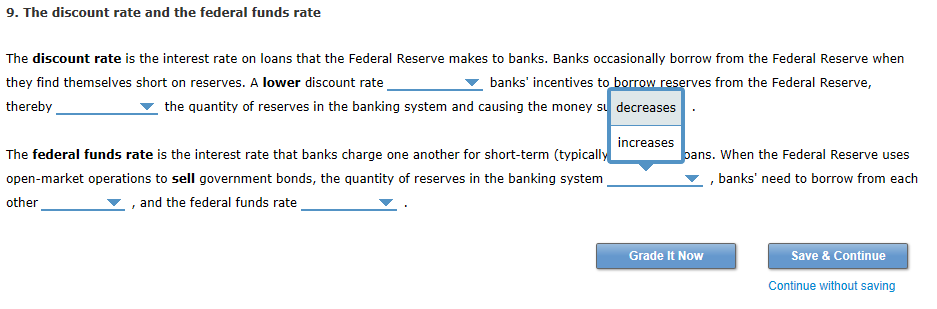

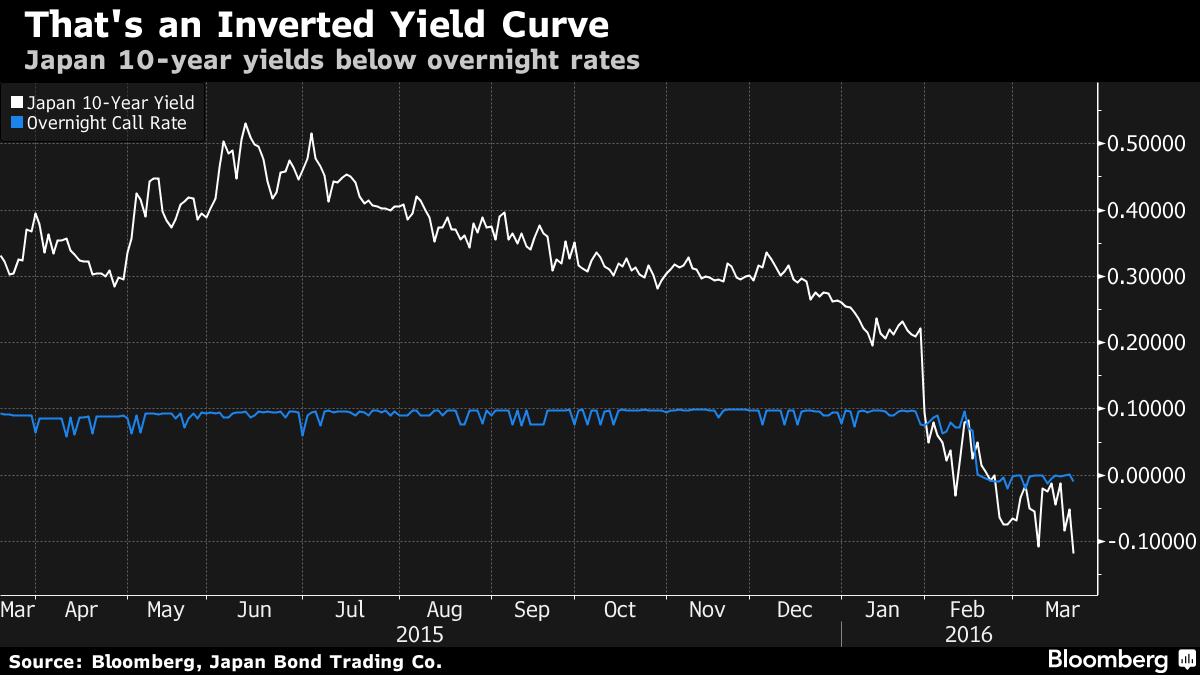

10 Year Treasury Forecast Jun 16, 2022 · Other Treasury Yield Resources of Interest: 10-Year U.S. Treasury Yield Historical Data; 10-Year Treasury Rates Extended Forecast by subscription; 91 Day T-Bill Yield Forecast; 30 Year U.S. Treasury Rates Forecast; 20 Year U.S. Treasury Rates Forecast; Prime Interest Rate Forecast; U.S. Treasury's Securities Website 10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once... Fed Funds Rate vs. US Treasury Yields - MacroMicro The difference between 30- and 10-year bond yield may reflect inflation expectations over the long-term; 10- and 2-year bond yield spread, on the other hand, may reflect the direction of Fed's interest rate decision; 10- and 3-month bond yield spread may reflect current market liquidity. 10 Year Treasury Rate - YCharts Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.25%, compared to 3.28% the previous market day and 1.52% last year.

What Is a 10-Year Treasury Note and How Does It Work? The basics of a 10-year T-note involve paying the government a single lump sum at the beginning to purchase the bond — $1,000 apiece. The government then pays interest twice a year until the bond matures, at which point the entire sum you borrowed will be returned. The interest rate, known as the "yield," expresses the annual return on ...

Rates for 10-year T-bonds hit 7.4% - msn.com The 10-year T-bonds landed a coupon of 7.25 percent and a rate of 7.145 percent, fetching bids from a low of 6.95 percent to a high of 7.37 percent. The coupon exceeded by 30.6 basis points the ...

10-Year Treasury Note Futures Prices & Futures Contract ... 10-Year Treasury Note Futures have helped investors protect capital for years, backed by the full faith and credit of the U.S. Government. These types of futures have gained popularity in the commodities market over the years because they can be used to hedge interest rate price risk for financial institutions, business and many large entities that are exposed to interest rate price risk.

A new 10-year TIPS will be auctioned Thursday. Anyone interested? On the purchase price: The coupon rate will be 0.125% and the real yield will probably be around -1.03%, leaving a 1.15% shortfall to create the premium price. We've never had a 10-year TIPS with a negative yield so low. On Jan 21, the yield was -0.987%, resulting in an adjusted price of $111.64.

How the 10-Year Treasury Note Guides All Other Interest Rates 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond 12 Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments.

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate. Subscribe; Sign In; Menu Search. Financial Times. myFT. Search the FT Search Search the ... US 10 year Treasury. Yield 3.23; Today's Change-0.008 / -0.24%; 1 Year change +124.18%; Data delayed at least 20 minutes, as of Jun 17 2022 22:05 BST. ...

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Long-Term Rates and Extrapolation Factors. Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may ...

T-bonds coupon rate 30.6bps higher than benchmark THE Bureau of the Treasury raised P34.9 billion last Tuesday after partially awarding the new 10-year Treasury bonds (T-bonds) as investors continue to seek higher yields. The security fetched a ...

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Coupon Rate 2.875% Maturity May 15, 2032 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points...

Individual - TIPS: Rates & Terms - TreasuryDirect Cumulative interest payments for 10 years = $447.43. Terms and Price TIPS are issued in terms of 5, 10, and 30 years, and are offered in multiples of $100. The price and interest rate of a TIPS are determined at auction. The price may be greater than, less than, or equal to the TIPS' par amount. (See rates in recent auctions .)

TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ Life & Work 5:00 PM EDT 06/17/22 Yield 3.236% Price 96 10/32 0/32 (0.00%) 1 Day Range 3.236 - 3.236 52 Week Range (Yield) 1.132 - 3.501...

Yield Calculation for a 10-Year Treasury Note | Sapling Current yield simply is the annual interest amount that a bond pays divided by the current price of the bond. For example, if you buy a bond with a $1,000 face value and an interest rate -- also known as the coupon rate -- of three percent, you'll earn $30 per year in interest.

United States Rates & Bonds - Bloomberg Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . 0.00: 1.54: 1.56% +59 ... Rate Current 1 Year Prior; FDFD:IND . Fed Funds Rate . 1.56: ... Muni Bonds 10 Year Yield . 2.91%: 0-5 +195:

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Price Day Low 96.3281 Coupon 2.875% Maturity 2032-05-15 Latest On U.S. 10 Year Treasury U.S. Treasury yields fall after tumultuous week 24 Hours AgoCNBC.com Treasury yields pull back from highs...

US.10: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 10 Year Treasury (US.10:Tradeweb) real-time stock quotes, news, price and financial information from CNBC.

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; , June 18, 2022. RELEASE TABLES H.15 Selected Interest Rates

10-Year T-Note Options Quotes - CME Group 10-Year T-Note Options - Quotes Venue: Auto-refresh is off There is currently no quotes data for this product. If you have any questions, please feel free to contact us. 10-Year Note Yield Curve Analytics Additional analytics for Treasury futures are available in our Treasury Analytics tool. View Yield calculation methodology here. CME FedWatch

Post a Comment for "45 coupon rate 10 year treasury"