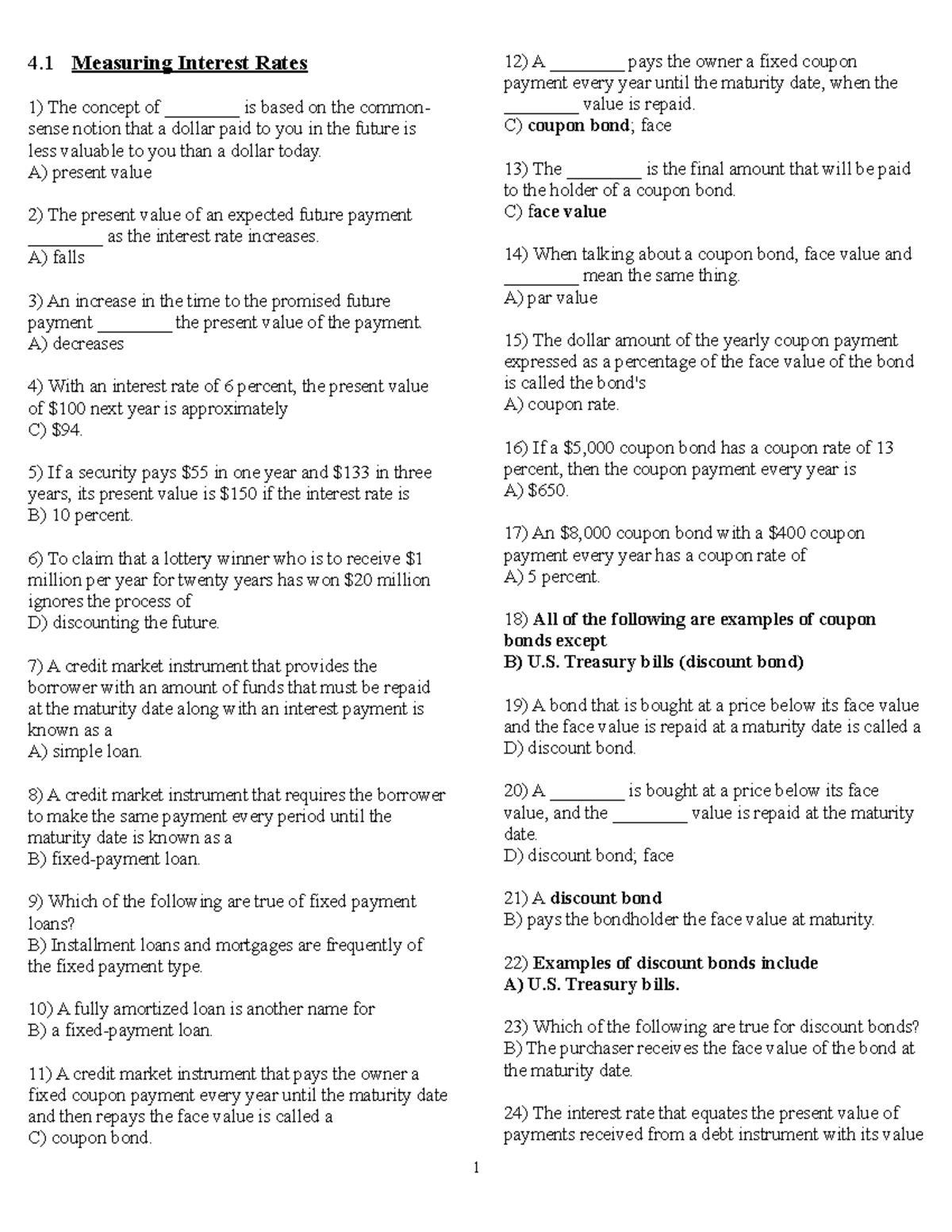

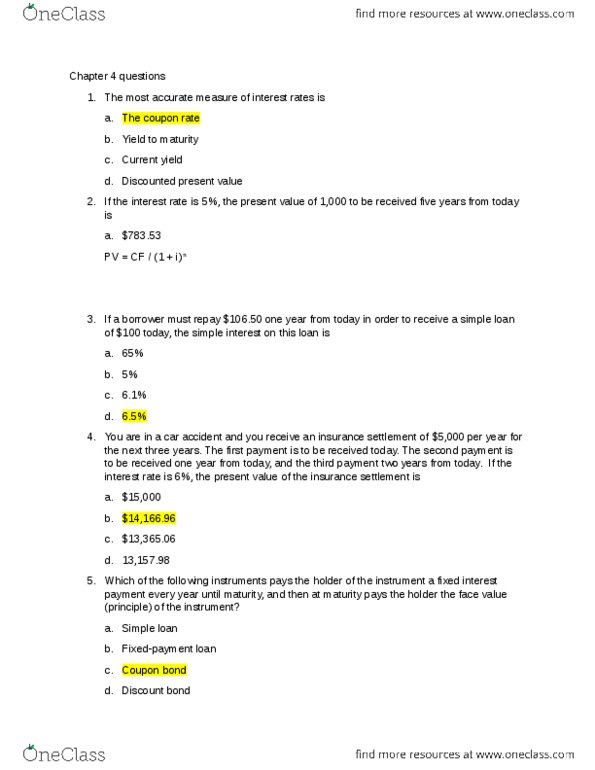

42 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

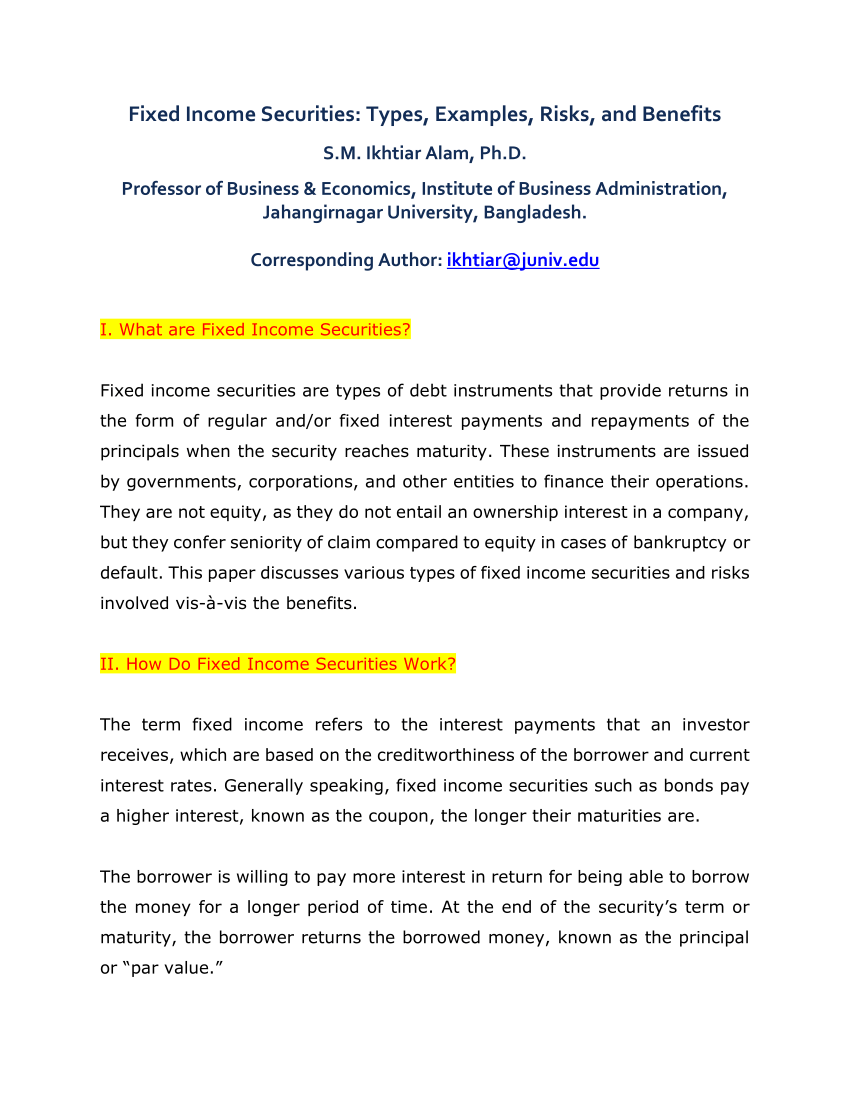

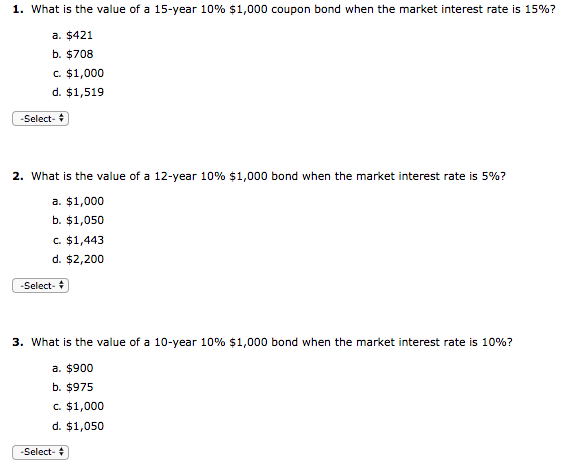

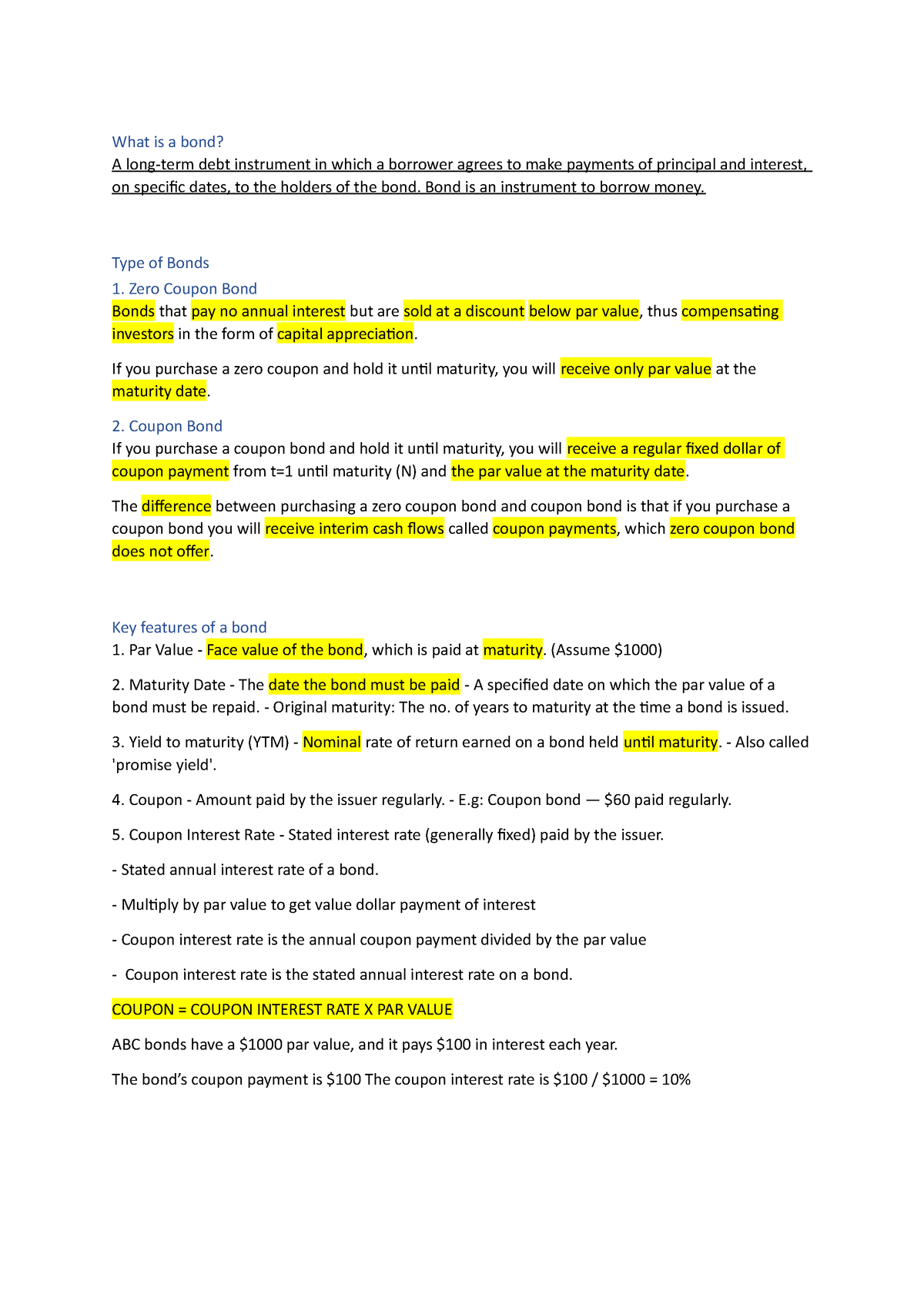

Coupon Rate of a Bond - WallStreetMojo Unlike other financial metrics, the coupon payment in terms of the dollar is fixed over the life of the bond. For example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the bondholder until its maturity. What Is the Bond Market and How Does it Work? - TheStreet When prices fall, yields rise, and vice versa. The reason is simple: Yield measures the value of a bond to an investor, depending on how much the investor paid for it. The lower the price at which ...

Why does the borrower pay more interest if the yield on a fixed coupon ... The borrower does not pay more interest in a fixed coupon, even if the yield goes up. Essentially, if the yield goes up, it means that the market price has gone down, below the face value (or earlier market value) of the bond. If a bond is issued at 100 and coupon is 4 annually, yield is 4% p.a..

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

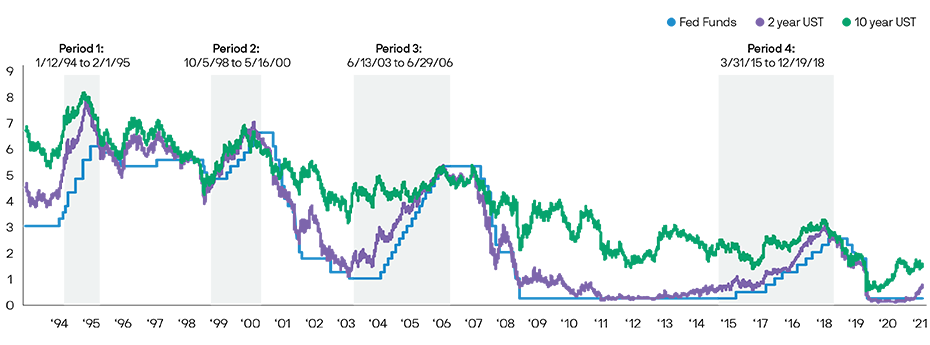

Mcq Bmc - Vsip.info If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? A- No, the price goes up, the yield goes up B- Yes, the price goes down, the yield goes up C- No, the price goes down, the payments are fixed D- Yes, the price goes up, the yield goes down How much will the Peruvian government spend on servicing its current debt outstanding for the given bond in 2025 according to this chart captured in 2019? A- 3000 Million Peruvian sol B- 4000 Million Peruvian sol C ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Fixed Income: As studied from your SFM textbook Vs as ... - CAclubindia This quote basically means that on this particular trading session, the yield has gone up, meaning, bond price has gone down. A LITTLE MORE ON THIS BOND AND ITS IMPORTANCE. It carries a coupon of 6.54% and its maturity date is 17 Jan, 2032. So this means that the yield on a 6.54% coupon paying bond is now above 7%.

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. What Is Bond Valuation? - The Balance A bond is a debt that is incurred by a company or government entity to finance a project or fund operations. Investors (also known as "bondholders") effectively lend money to the borrower (the issuer of the bond) by buying these debt instruments. The borrower pays an annual interest rate (also referred to as the "coupon rate"), which can be ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Negative yields mean the lender pays the borrower to borrow. This has never happened at a large scale in the history of humanity & in June of 2019 over $13 trillion in bonds have negative yields globally. A negative yielding zero coupon bond would have an investor buying it at above par, paying more than face value. What are bonds and how do they work? - BBC News If the price of a bond goes up the yield falls. That is because you are paying more for a given stream of payments in the future. If you had paid £850 for that hypothetical bond, then the yield ...

What are bonds and how do they work? - BBC News If the price of a bond goes up the yield falls. That is because you are paying more for a given stream of payments in the future. If you had paid £850 for that hypothetical bond, then the yield ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. If the yield on a fixed coupon bond goes up, does the borrower have to ... No. The borrower does not pay more interest. "…the yield on a fixed coupon bond goes up…" means that the price of the bond declines. If the borrower borrows $1 billion at a rate of 3%, that means (generally, more-or-less) that the borrower pays $15 million twice per year as interest. Increase in bond yields: Impact on investors - Financialexpress As companies/government issues bonds to raise money, they pay a fixed interest to the bondholders which is popularly known as the coupon rate. It is declared upfront and payable on the face value...

Bloomberg.docx - Bloomberg Currency: Three of the main... 2. If the yield on a fixed-coupon bond goes up, the borrower doesn't have to pay more interest. But if the price of the bond is lower, a new investor receives a higher yield, or APR, on his or her investment. 3. Servicing debt refers to sustaining one's existing amount of borrowing by paying coupons, the yellow bars. The blue bars refer to principal repayments. Solved If the yield on a fixed-coupon 'bond goes up, does - Chegg The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Question: If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. Bond Coupon Interest Rate: How It Affects Price - Investopedia Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon payments remain static. 2 For instance, a... Bond duration - Wikipedia The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a total of $1050. Discounting to present value at 6.5%, the bond value is $937.66. The detail is the following:

(Solved) - If the yield on a fixed-coupon 'bond goes up, does the ... 1 Answer to If the yield on ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Investing Flashcards | Quizlet Company A pays a dividend of 2%. Company B's stock price increases 1% plus the inflation rate every year. Company C pays 3% dividends, and its stock price decreases every year by 2%. Company D pays 0% dividends, an its stock price does not increase year over year. If the companies are otherwise identical, which would you invest in?

Currencies and Fixed Income Flashcards | Quizlet Prospective borrows are unhappy as they would have to promise to pay back relatively more to secure a loan If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down and the payments are fixed

D7223F5B-B2AE-489C-8162-07DB6623D3E9.jpeg - KNOWLEDGE CH... View D7223F5B-B2AE-489C-8162-07DB6623D3E9.jpeg from AE MISC at Wilmington University. KNOWLEDGE CH ECK If the yield on a fixed—coupon bond goes up, does the borrower have to pay more interest? Yes,

Exploring the Opportunity for DeFi Interest Rate Markets However, fixed-rate borrowers may be unhappy with the terms of their loan (and/or have the view that rates across the economy will go down), and may swap their exposure with a different borrower who is currently paying variable but wants a fixed rate. Lenders who own fixed-rate bonds may have the view that rates across the economy will go up ...

Relationship Between Bond Yields, Interest Rates, and Inflation As the price of the bond goes up, the yield falls, and vice versa. The price of a bond keeps changing almost on a daily basis due to prevailing interest rates. Lower interest rates make the bond...

(Solved) - KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up ... No, the price goes down. The ...

What Happens When a Bond Matures? - Debt Quest The market values of bonds are deemed volatile because they can be traded even before their maturity. For example, an issued bond at $1000 given a 7% yield initially means that both the current and the nominal yield are at 7%. If the investor later trades off the bond at $900, there is an increase in current yield amounting to 7.8% ($7 or $900).

Fixed Income: As studied from your SFM textbook Vs as ... - CAclubindia This quote basically means that on this particular trading session, the yield has gone up, meaning, bond price has gone down. A LITTLE MORE ON THIS BOND AND ITS IMPORTANCE. It carries a coupon of 6.54% and its maturity date is 17 Jan, 2032. So this means that the yield on a 6.54% coupon paying bond is now above 7%.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Mcq Bmc - Vsip.info If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? A- No, the price goes up, the yield goes up B- Yes, the price goes down, the yield goes up C- No, the price goes down, the payments are fixed D- Yes, the price goes up, the yield goes down How much will the Peruvian government spend on servicing its current debt outstanding for the given bond in 2025 according to this chart captured in 2019? A- 3000 Million Peruvian sol B- 4000 Million Peruvian sol C ...

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Post a Comment for "42 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"