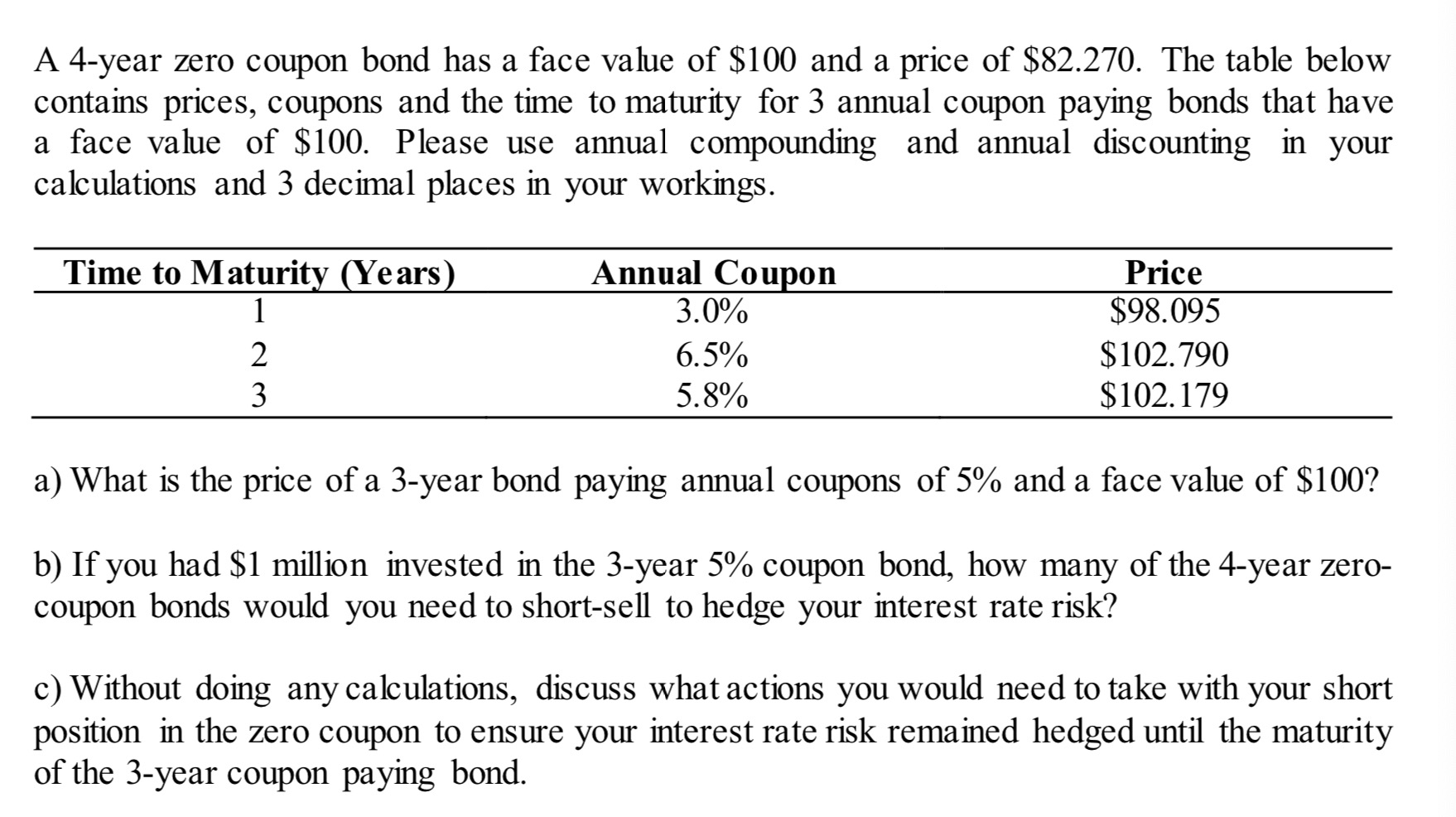

42 zero coupon bond value

Zero-Coupon Bond - Definition, How It Works, Formula 28.1.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than … Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators, Zero coupon bonds are yet another interesting security in the fixed income world.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve …

Zero coupon bond value

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a... Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How to Calculate the Price of a Zero Coupon Bond Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

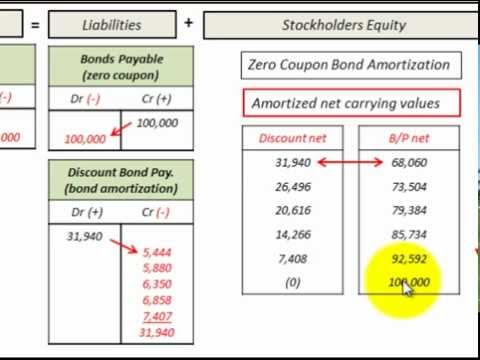

Zero coupon bond value. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. A single payment of $20,000 ... Zero Coupon Bonds: Know tax rules when such a bond is held till ... As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don't get regular interest, but get a deep discount on face value at the time of issuance of such a bond. Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity, How Does the IRS Tax...

Zero Coupon Bond | Investor.gov Zero Coupon Bond, Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The value of zero-coupon bond will continue to increase till it reach $100,000 at the time of its maturity. Total dollar amount of interest earned by Andrews would be $50,000 ($100,000 minus $50,000). by Obaidullah Jan, ACA, CFA and last modified on May 17, 2020, Zero Coupon Bonds Explained (With Examples) - Fervent Zero Coupon Bonds, aka "Deep Discount Bonds", or "ZCBs" are bonds (a type of debt instrument) that don't pay any coupons (aka interest). In other words, there is no coupon payment (aka interest payment). They pay a zero coupon. Hence the name, zero coupon bond. The only thing they do pay is the Par (aka "face value") when the bond matures. Zero Coupon Bond | Definition, Formula & Examples Feb 18, 2022 — The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 ...

Zero Coupon Bond Value Calculator - bizimkonak.com Zero Coupon Bond Value - Formula (with Calculator) CODES (9 days ago) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, … Zero Coupon Bond Calculator - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate. Zero-Coupon Bond Value | Formula, Example, Analysis ... The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is, Price = M / (1+r)n, where: M = maturity value or face value of the bond, r = rate of interest required, n = number of years to maturity, 3. Zero Coupon Bonds - Financial Edge What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Features of Zero-Coupon Bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero Coupon Bonds have no reinvestment risk however they carry interest rate risk. The accumulated interest is paid at the time of maturity. Includes a maturity period of 10 to 15 years.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula, Sale Price = FV / (1 + IR) N,...

A zero coupon bond has a par value of r1 000 if the A zero-coupon bond has a par value of R1 000. If the bond matures in 4 years and is currently selling for R635.52, what is the YTM? A. 10% B. 11% C. 12% D. 14%. 77. A coupon bond pays interest semi-annually, matures in 5 years, has a par value of R1 000 and a coupon rate of 12%, and an effective annual yield to maturity of 10.25%.

Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 — A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is ...

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at …

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because people could...

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org the value of your zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000.

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11, This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000....

Bond Discount - Investopedia 29.5.2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are issued at a minimum face value of $1,000, and the earliest a Treasury zero bond matures is in 10 years. The bond interest income is taxed at the federal level and possibly at the ...

How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds, Most bonds typically pay out a coupon every six months.

Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity date, one ...

Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ...

Zero - definition of zero by The Free Dictionary Define zero. zero synonyms, zero pronunciation, zero translation, English dictionary definition of zero. n. pl. ze·ros or ze·roes 1. The numerical symbol 0; a cipher. 2.

How to Calculate the Price of a Zero Coupon Bond Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a...

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 zero coupon bond value"