38 coupon rate and ytm

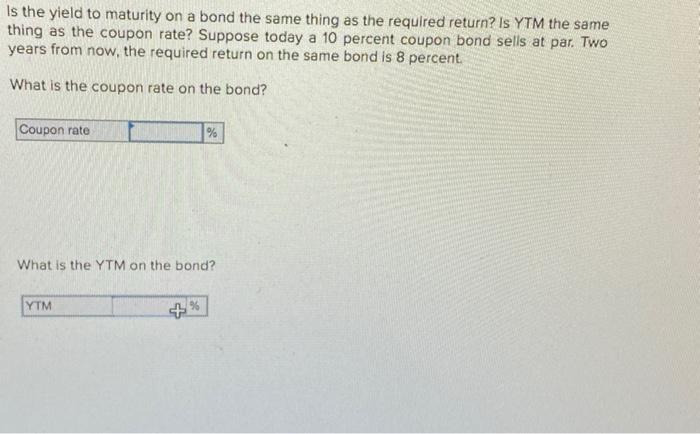

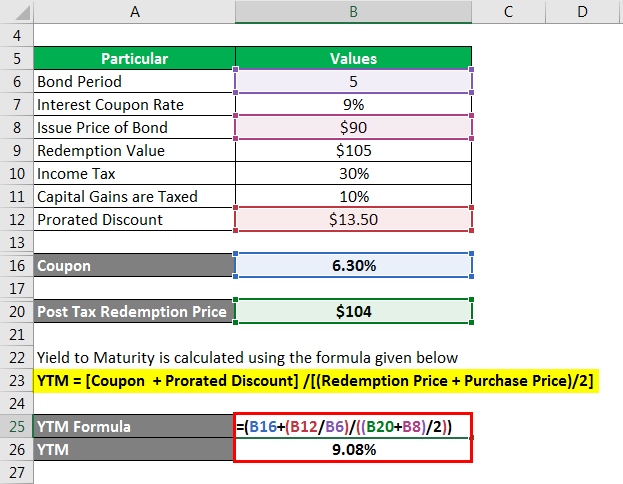

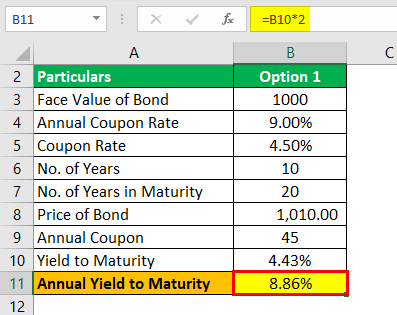

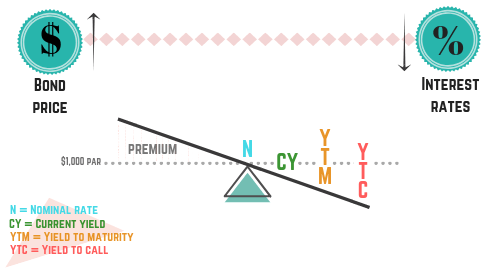

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ... How to Calculate Yield to Maturity (YTM) - Wall Street Prep An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the ...

Bond Yield to Call (YTC) Calculator - DQYDJ Coupon Payment Frequency - How often the bond makes coupon payments. Bond YTC Calculator Outputs. Yield to Call (%): The converged upon solution for the yield to call of the current bond (the internal rate of return assuming the bond is called). Current Yield (%): The simple calculated yield which uses the current trading price and face value ...

Coupon rate and ytm

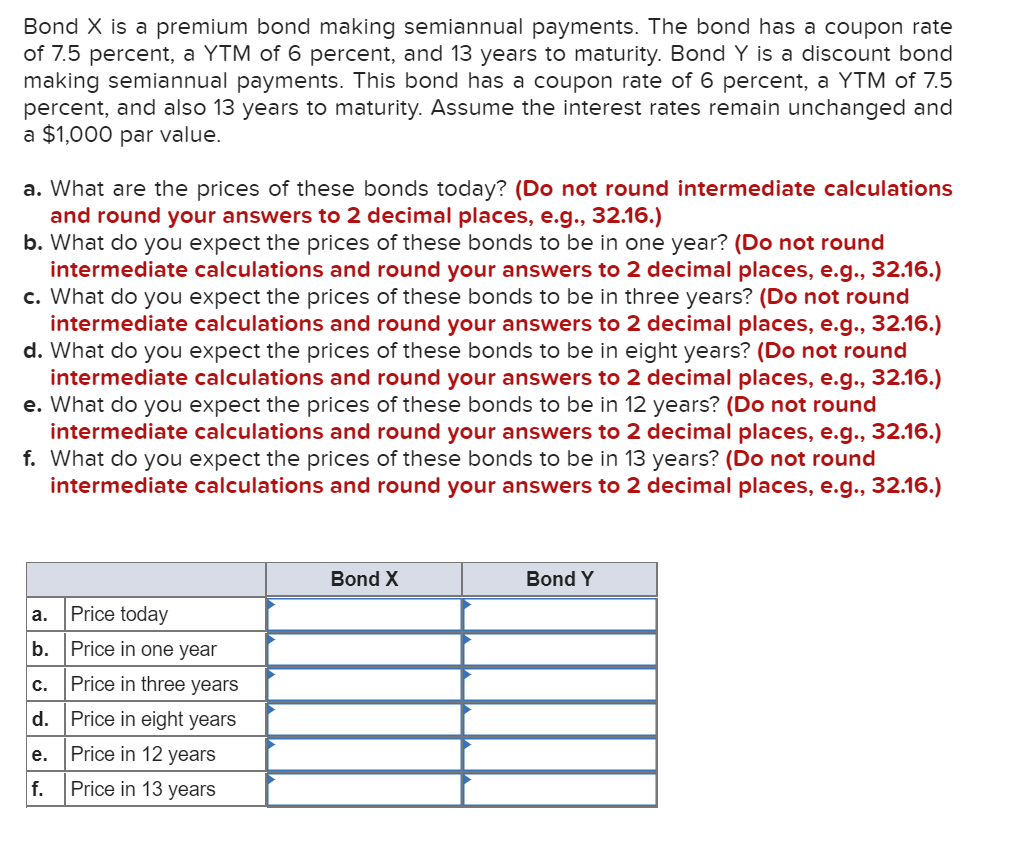

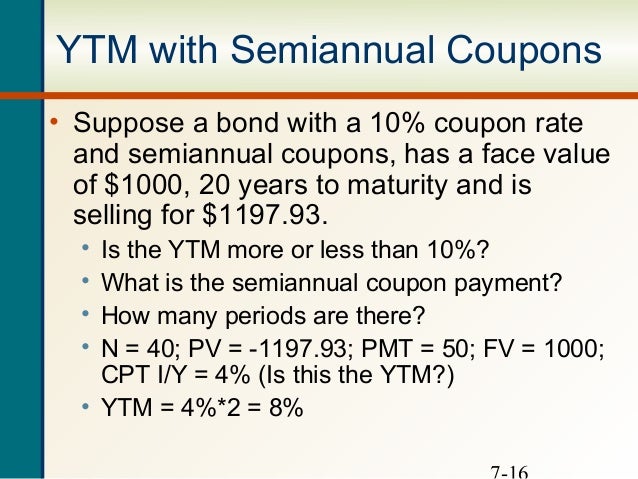

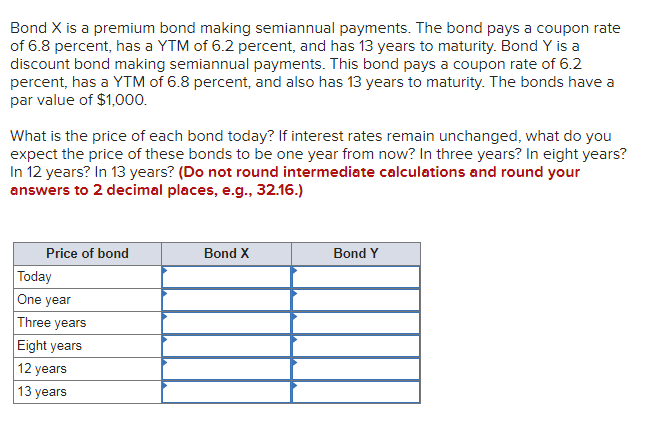

Macaulay Duration vs. Modified Duration: What's the Difference? Sep 19, 2022 · For example, consider a three-year bond with a maturity value of $1,000 and a coupon rate of 6% paid semi-annually. The bond pays the coupon twice a year and pays the principal on the final payment. Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total ... When a Bond's Coupon Rate Is Equal to Yield to Maturity A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

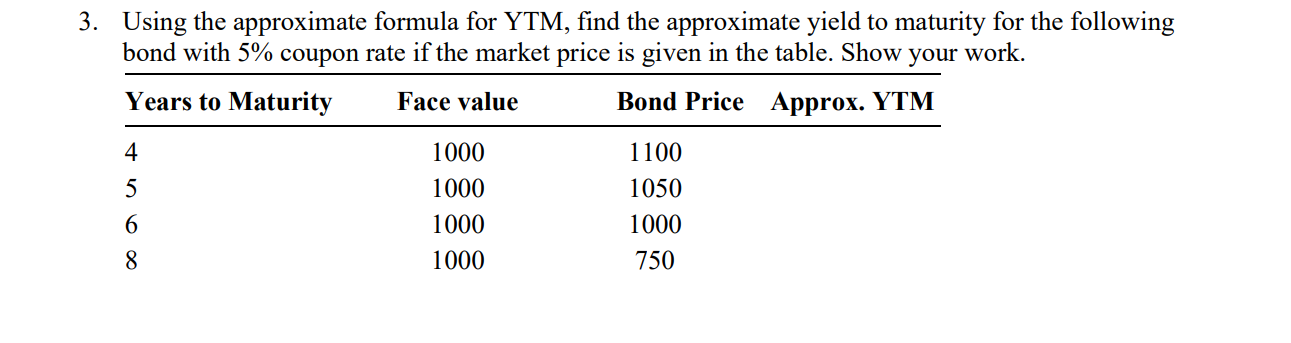

Coupon rate and ytm. Difference between Coupon Rate And Yield To Maturity - Angel One Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per ... Yield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1. The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a ...

The Difference Between Coupon and Yield to Maturity - The Balance Mar 4, 2021 ... To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount ... Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube Aug 3, 2021 ... In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield ... Basics Of Bonds - Maturity, Coupons And Yield Sep 19, 2022 · The coupon is always tied to a bond’s face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500. Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

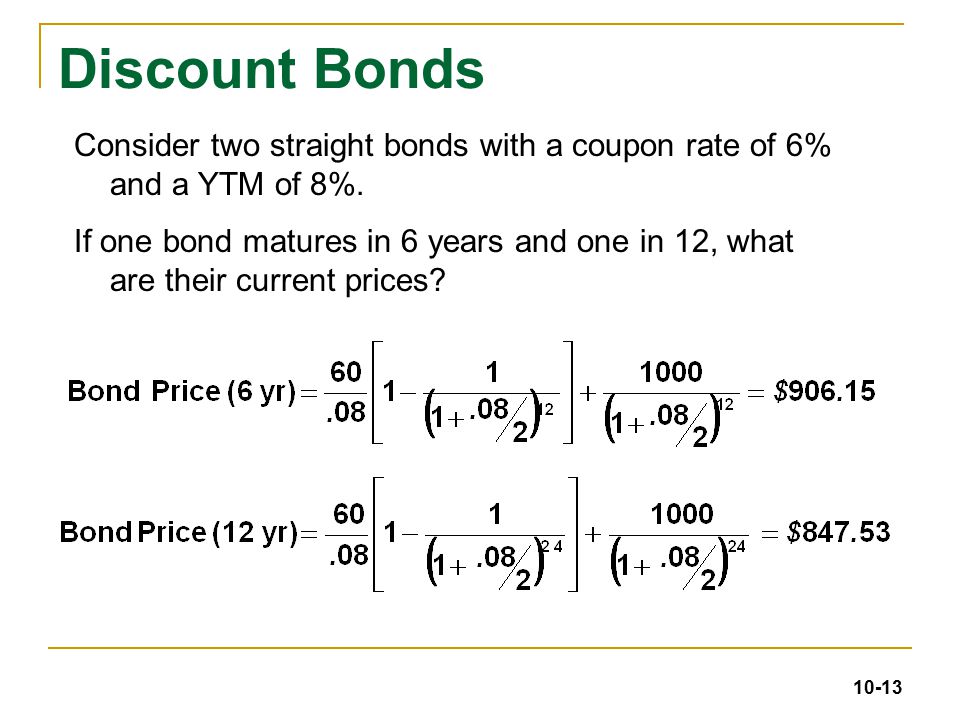

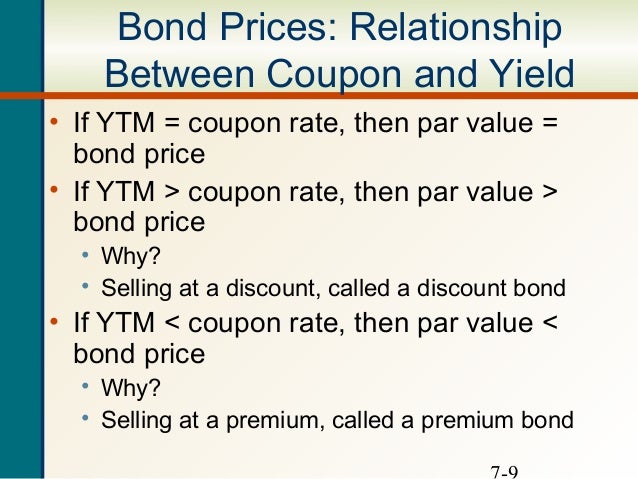

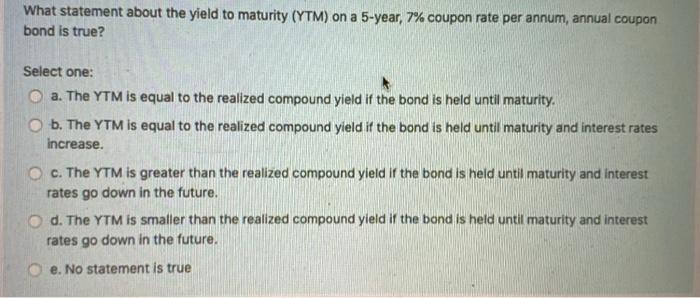

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Coupon Rate Definition - Investopedia 28/05/2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Relationships among a Bond's Price, Coupon Rate, Maturity, and ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM ... Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ...

When a Bond's Coupon Rate Is Equal to Yield to Maturity A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total ...

Macaulay Duration vs. Modified Duration: What's the Difference? Sep 19, 2022 · For example, consider a three-year bond with a maturity value of $1,000 and a coupon rate of 6% paid semi-annually. The bond pays the coupon twice a year and pays the principal on the final payment.

Post a Comment for "38 coupon rate and ytm"