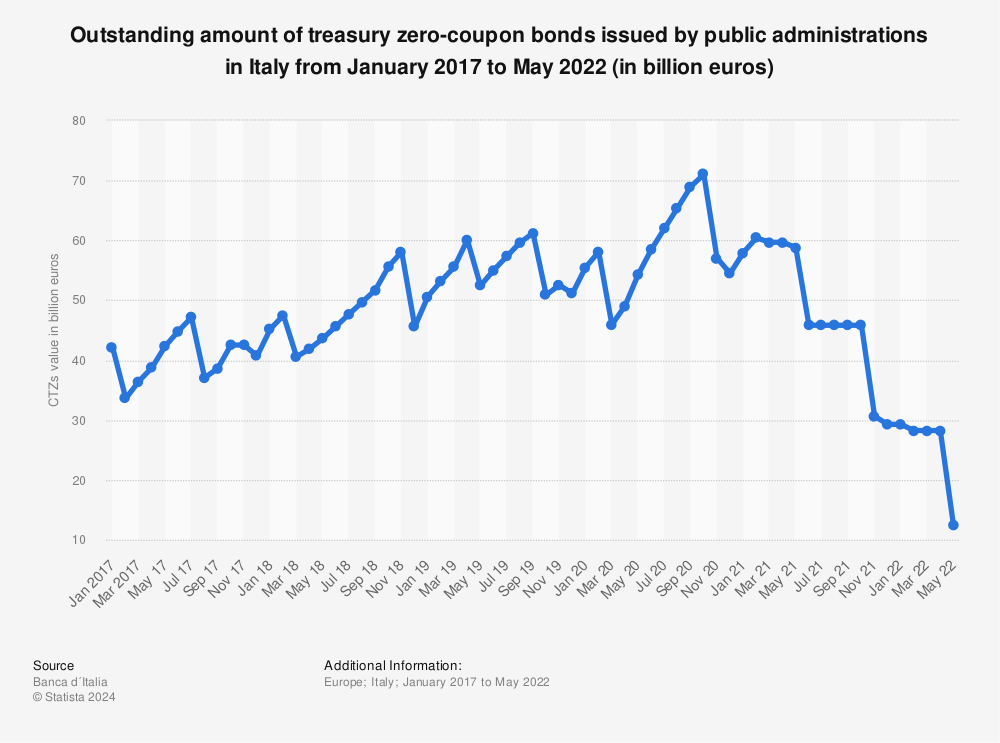

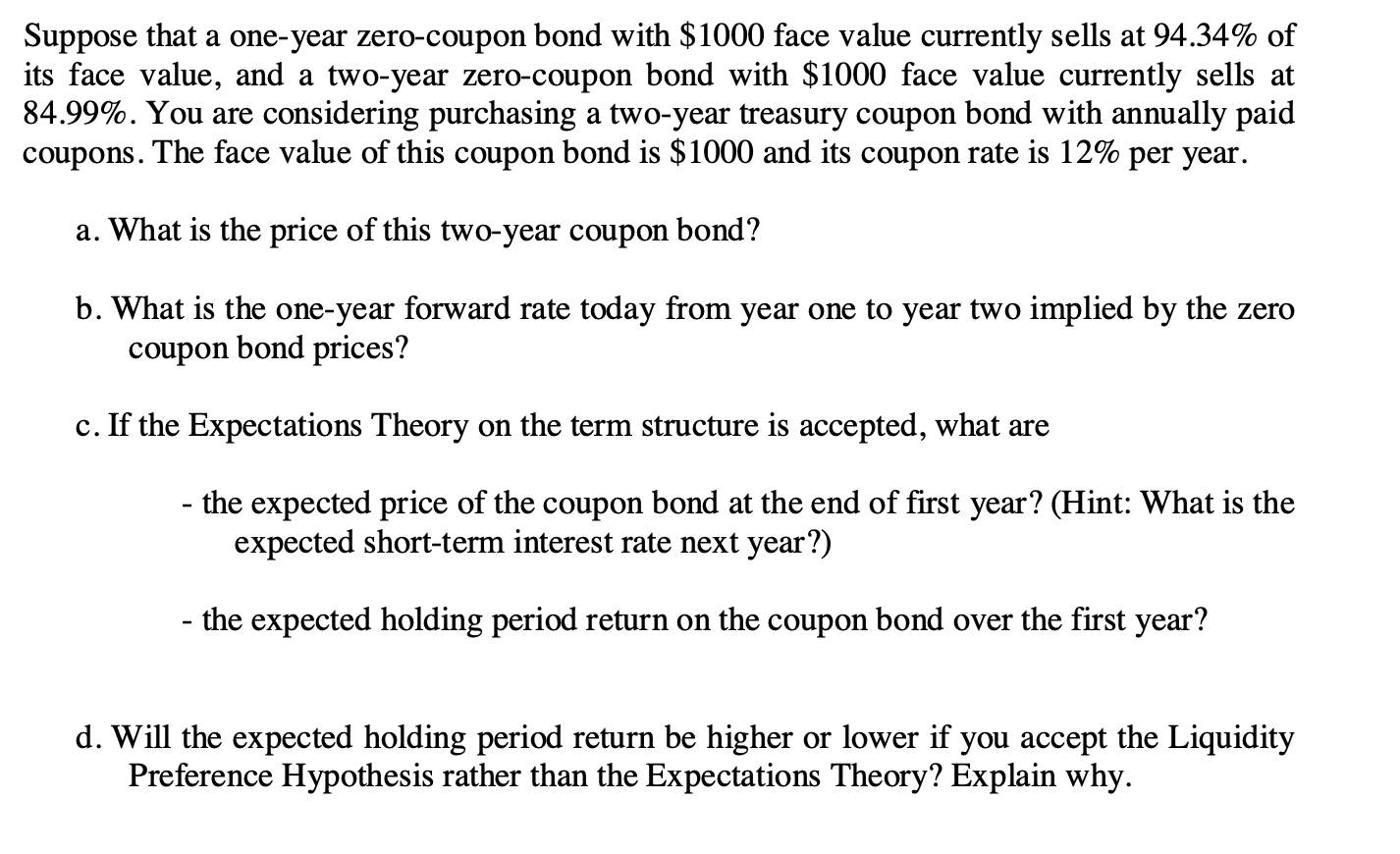

44 treasury zero coupon bond

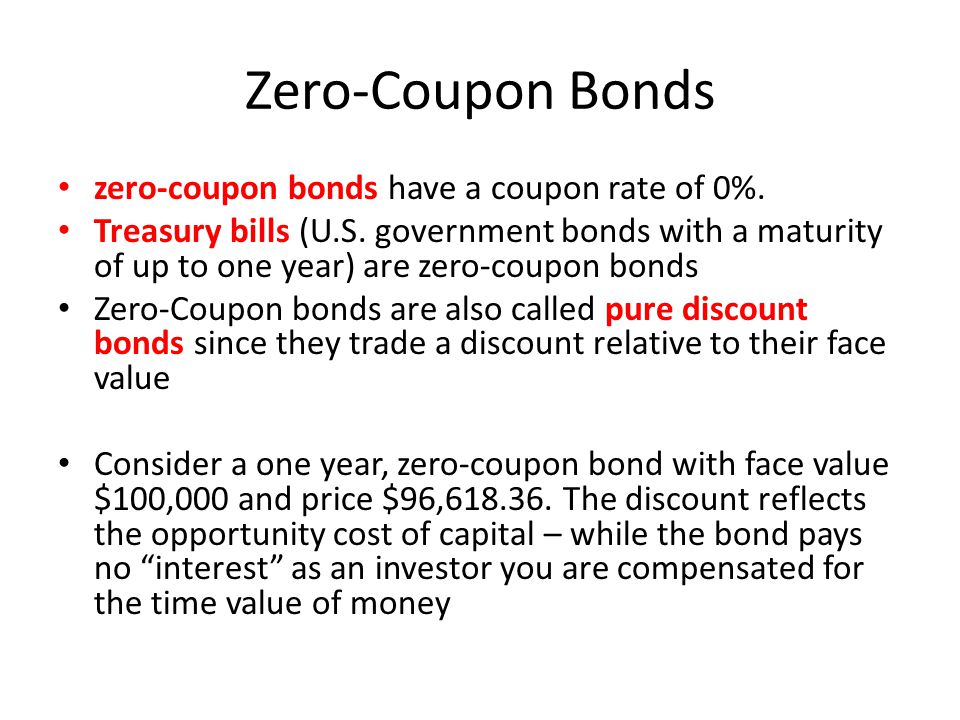

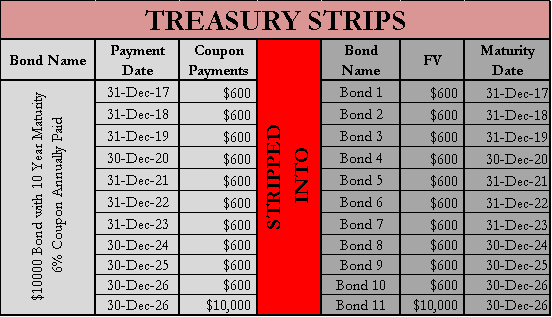

Zero-Coupon Bond - Wall Street Prep Even though the bondholder technically does not receive interest from the zero-coupon bond, so-called “phantom income” is subject to taxes under the IRS. However, certain issuances can avoid being taxed, such as zero-coupon municipal bonds and Treasury STRIPS. Zero-Coupon Bond Exercise – Excel Template Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than $100 in one year.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

Treasury zero coupon bond

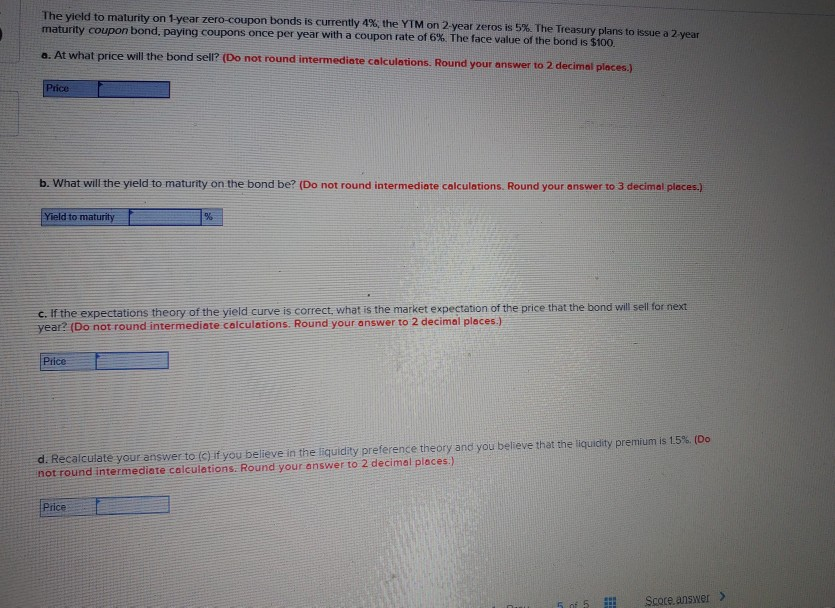

United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. Markets Explained | Project Invested Bond Markets Defined. Markets Explained. Understanding “Call” and Refunding Risk. Markets Explained. Fixed-Rate Securities. Markets Explained. Potential Benefits ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

Treasury zero coupon bond. Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Markets Explained | Project Invested Bond Markets Defined. Markets Explained. Understanding “Call” and Refunding Risk. Markets Explained. Fixed-Rate Securities. Markets Explained. Potential Benefits ... United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006.

/GettyImages-597139701-d3b44a08d65844a89c458a6ed9950100.jpg)

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

Post a Comment for "44 treasury zero coupon bond"